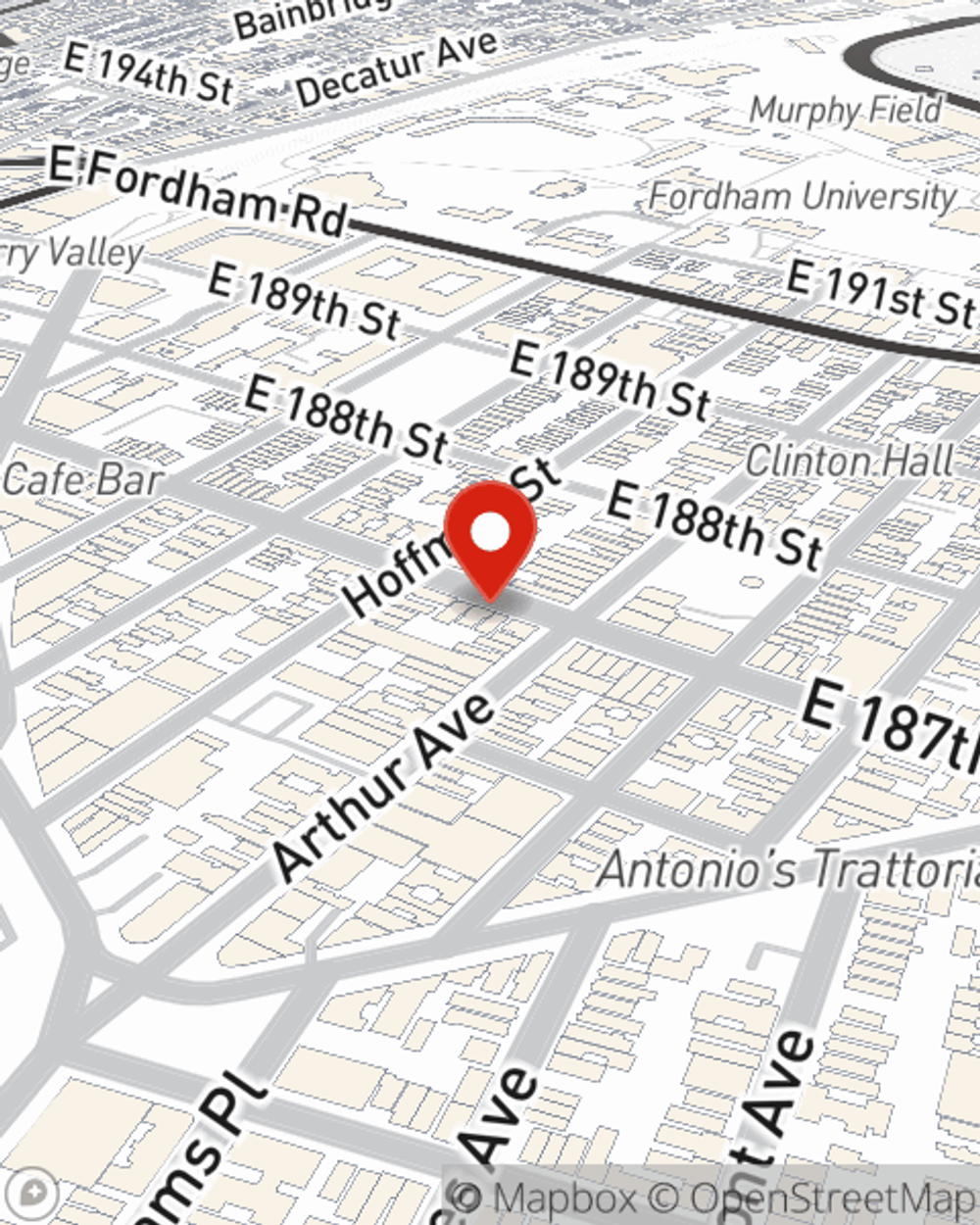

Business Insurance in and around Bronx

Looking for small business insurance coverage?

Insure your business, intentionally

- New York City

- The Bronx

- New Jersey

- Westchester County

- Yonkers

- Rockland County

State Farm Understands Small Businesses.

When you're a business owner, there's so much to focus on. You're in good company. State Farm agent Hector Camilo Jr is a business owner, too. Let Hector Camilo Jr help you make sure that your business is properly insured. You won't regret it!

Looking for small business insurance coverage?

Insure your business, intentionally

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your compensation, but also helps with regular payroll overhead. You can also include liability, which is critical coverage protecting your company in the event of a claim or judgment against you by a visitor.

At State Farm agent Hector Camilo Jr's office, it's our business to help insure yours. Contact our wonderful team to get started today!

Simple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Hector Camilo Jr

State Farm® Insurance AgentSimple Insights®

Disaster preparedness for your business

Disaster preparedness for your business

Create a business disaster plan to protect your employees, secure assets and resume operations.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.